PORTFOLIO MANAGEMENT

Implementing Active Management in Client Portfolios

The more you explore Active Investment Management, the more resources open up to the investor. In my money management practice, I have opted to look for the best active managers I can find and subscribe to their systems and signals. This means extensive due diligence on their models over different market cycles to understand their strengths and weaknesses. My goal is to build consensus or identify viable investment opportunities from diversified views of the financial market. This information is then used to position client assets with the intent to capture current market opportunities and make money regardless of market conditions.

Over a full market cycle, client portfolios might range from extensive market exposure to a market neutral posture or net short the market. Investment vehicles could include index funds, leveraged index equity or bond funds, long-short funds, a managed futures fund, a covered call options fund and a variable annuity that provides some guaranteed accumulation and guaranteed payout.

I believe this active approach is essential to portfolio success in our current market environment. Managing money without Active Management is like playing baseball without a bat. The only way to get on base is to hope that the pitcher walks you or hits you with the pitch. Without Active Management the only way to make money is to hope that the stock market goes up which it hasn’t in the past ten years. Active Management gives us the opportunity to make money in up, down or flat markets.

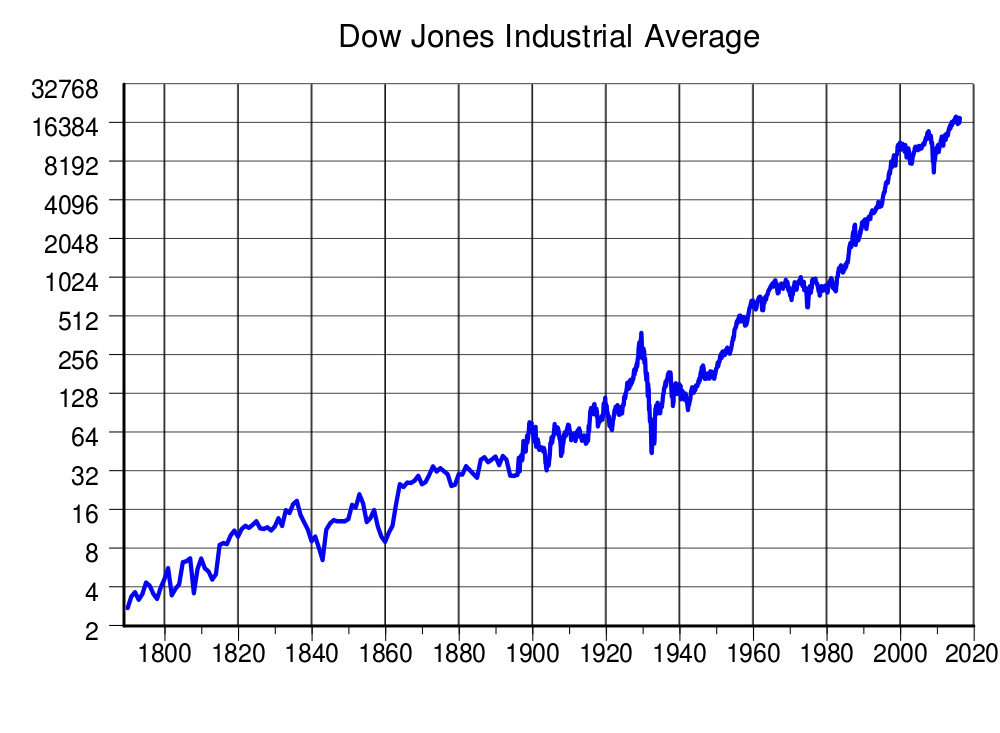

Market cycles span decades

The graphic below illustrates the cyclical nature of markets and the need to adapt investment strategies to fit the current market. Investing in a bull market is very different than the strategies required to profit in a sideways or bear market.

Understanding the Market Environment

This email address is being protected from spambots. You need JavaScript enabled to view it.