ACTIVE INVESTING

The Traditional MPT Approach and Why it Doesn’t Work

Given a choice of cars to purchase, would you buy one developed in 1952? That was the year Modern Portfolio Theory (MPT) was first published. Today the majority of investment advisers still follow its basic principles – (1) Diversify among non-correlated assets to reduce risk and optimize return. (2) Rebalance periodically to sell portions of positions that have experienced the greatest gain and purchase more of the underperforming asset classes to return to the original allocation.

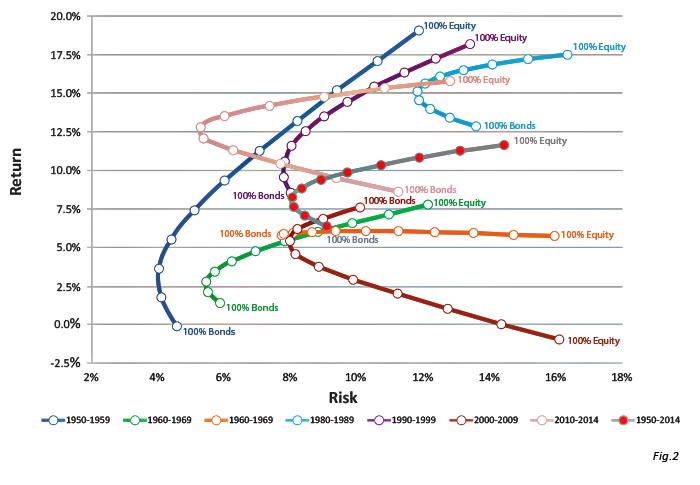

The problem is that correlations change in different market cycles, limiting MPT’s ability to moderate risk. In severe market declines, correlation has increased to the point where virtually all asset classes headed in the same direction – down. In the bear markets of the 2000 decade, balanced portfolios typically mirrored or exceeded the losses of the major indices.

The second stage of MPT, rebalancing, forces an investor to sell the best performing assets in the portfolio to buy the worst, limiting the return potential of the portfolio.

A lot has changed since 1952. Regardless of whether we’re talking cars or financial markets, it’s a global market and a dangerous ride if you aren’t on top of where you are and where you are headed. Complexity is greater. Everything is moving faster. Obsolescence is just around the corner. The big problem with Modern Portfolio Theory, however, is that it lacks tools to react to current market conditions. The investor is stuck on autopilot.

A lot has changed since 1952. Regardless of whether we’re talking cars or financial markets, it’s a global market and a dangerous ride if you aren’t on top of where you are and where you are headed. Complexity is greater. Everything is moving faster. Obsolescence is just around the corner. The big problem with Modern Portfolio Theory, however, is that it lacks tools to react to current market conditions. The investor is stuck on autopilot.

Transitioning to Active Investment Management

My conversion to Active Investment Management came the hard way. I believed in asset allocation and MPT, until I had to face the devastation of my clients’ portfolios in 2000-2002. I knew there had to be a better way to manage portfolios; a way that had the potential to react quickly to market declines and preserve portfolio values. As I researched investment vehicles, strategies and managers, active management approaches kept coming to the forefront. The discovery of the National Association of Active Investment Managers (NAAIM), a peer group for investment advisors utilizing active investment strategies, brought contact with hundreds of managers throughout the U.S., who like me, believed there had to be a better way.

Active investment management is based upon research studies indicating what market professionals have long known: that market

events are not random and that discoverable relationships exist between different data and the performance of financial markets.

Using the power of computers and quantitative technical analysis, investment managers have developed strategies designed to take advantage of these relationships. These strategies look for trends in the market’s relentless cycles and fluctuations to detect periods of sustained up or downward movements and to identify asset classes that appear to have the greatest potential for outperformance given the current market trend. During a perceived “UP” leg of the market, investments are positioned in targeted asset classes to achieve the

greatest return. When the market appears to have topped out, assets are repositioned or, in severe market declines, may be moved into a cash, bond or short position (inverse the market), until the next UP period.

Not every trade will be a winner and active management will not beat a buy-and-hold position each period. But over time, reducing the portfolio’s loss during down markets can not only reduce the volatility of the portfolio but also improve return over the long run. The reason is the mathematics of gains and losses. It doesn’t take a 50% return to make up a 50% loss. It takes a 100% gain. A consistent 5% return from 2001-2010 would have outperformed the S&P 500 index by 62%, despite years when the S&P 500 gained 28.7%, 15.8% and 26.5%. (S&P 500 total return data from Ibbotson SBBI 2011 Classic Yearbook)